Trust Documents

Sanstha was established as a voluntary non-government charitable organization under the Indian Trust Act 1882.

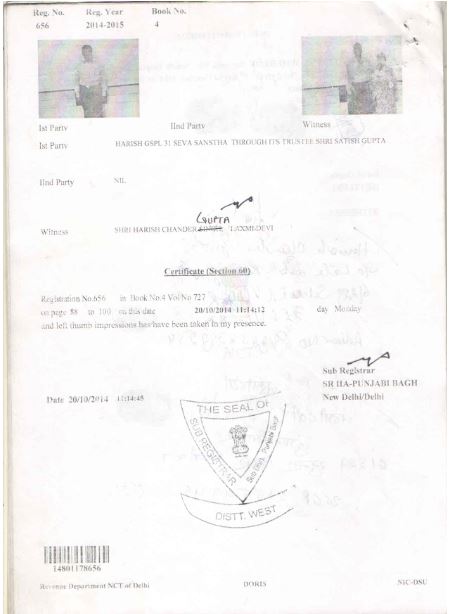

Trust registration certificate under section 60 =>Registration no. 656 in book no.4 ( 2014 - 2015 )

" NITI Aayog " => Unique ID : " DL / 2020 / 0253068 "

Companies can contact us to disbursement their CSR FUND for Education sector or other sectors in public.

Spl. :=>We provide facility of disburse the companies funds in their name in public.

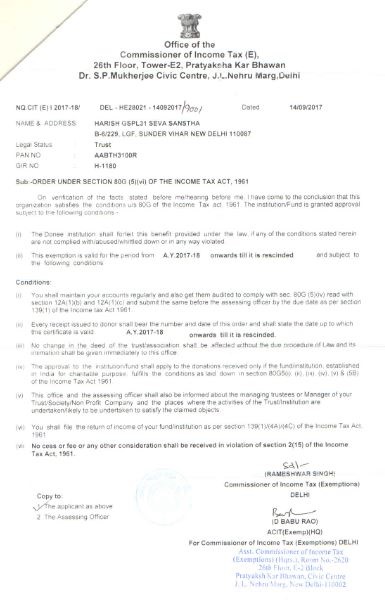

80G Certificate of Income Tax => Trust registration no. : " DEL - HE28021 - 14092017 "

U/s 80G(5)(vi) of the Income Tax Act 1961, exemption valid from F.Y. 2016-2017 / A.Y. 2017-2018 onwards till it is rescinded.

ALL DONATIONS TO US ARE ELIGIBLE FOR 50% TAX RELIEF UNDER SECTION 80G OF INCOME TAX ACT 1961.